95% of the top residential developers and agents in London use Molior

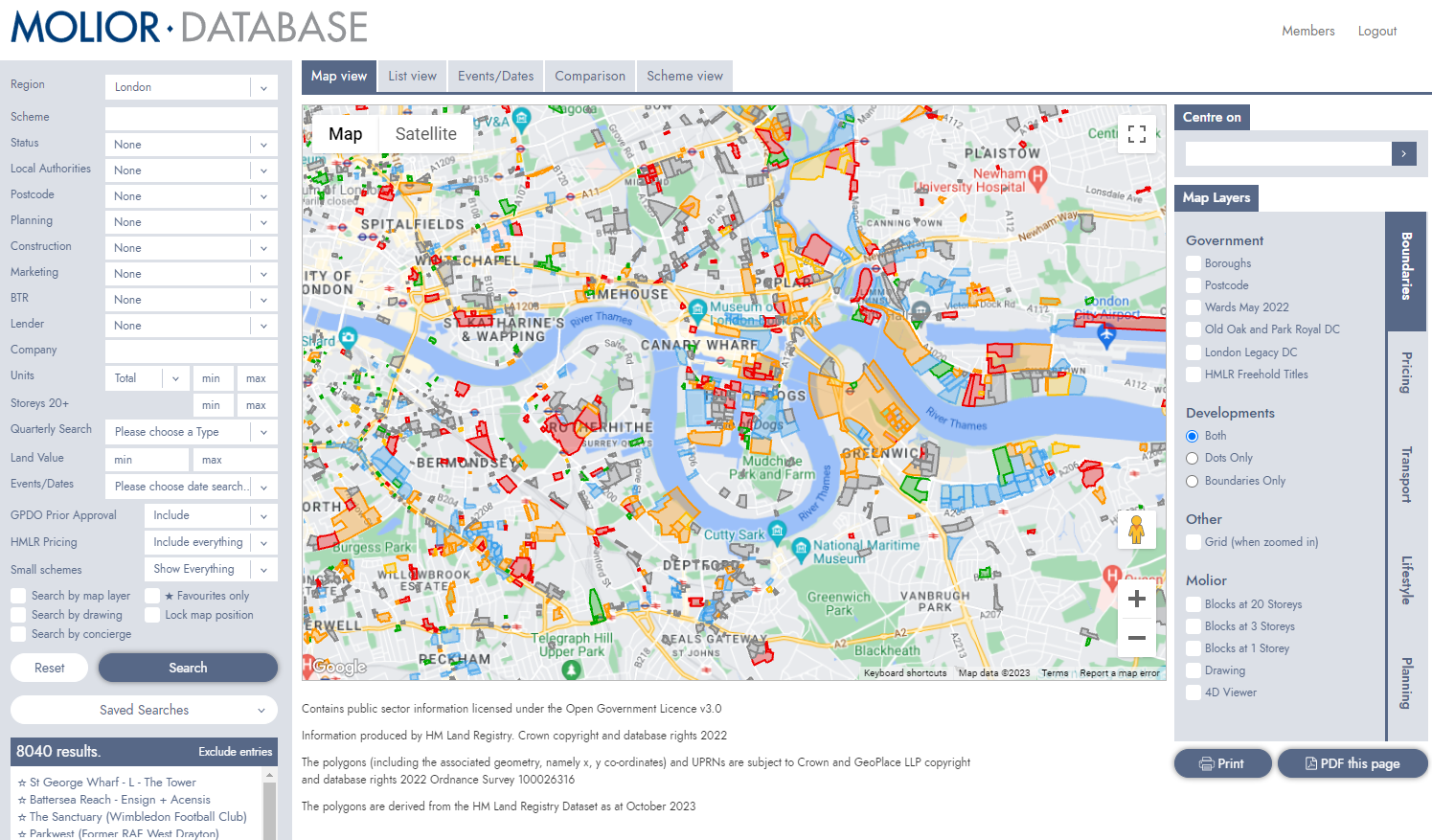

Molior London combines research, technology, and extensive interviews to provide an information service on the residential development industry in London. The service is for serious investors and developers making important decisions on market opportunities and risks.